Dealing with a home insurance claim can feel overwhelming, especially when you don’t fully understand how to deal with insurance adjuster for home after unexpected damage. The adjuster isn’t your friend — they are hired to protect the insurance company, not your personal loss. This is where many homeowners make costly mistakes. Knowing how to communicate properly, negotiate with insurance adjuster, and avoid lowball insurance settlement offers can directly impact your payout. The goal is to protect your rights, prevent bad faith insurance claim behavior, and take control of the home insurance claim settlement process from the first phone call — not after it’s too late.

How to Deal with Home Insurance Adjusters full guide 2025

If you’re looking for a deeper breakdown of how adjusters actually handle home damage claims step-by-step, you can also check my detailed guide on how to deal with home insurance adjusters. It explains the psychology of adjusters and how to avoid being lowballed in the very beginning.

A typical claim follows four stages: incident report, adjuster inspection, estimate calculation, and settlement offer. During this time, the company quietly applies insurance adjuster negotiation tactics to reduce your payout. They observe your emotions, confidence, and understanding of your policy. If you sound unsure, they begin slow-play strategies, request repetitive documents, or strategically mention exclusions to mentally weaken you early in the process.

The Real Role of an Insurance Adjuster (And Their Limits)

Most homeowners mistakenly trust the adjuster as a neutral investigator. But the truth is — the adjuster is not your financial ally. Their job is to avoid lowball insurance settlement offers from turning into high losses for the company, not to ensure maximum compensation for you. They are trained to legally justify paying you the least possible amount while appearing helpful during every call.

However, they do have strict limits. They cannot misrepresent your contract or ignore evidence you provide. If they do, that falls under bad faith insurance claim behavior, which is a legal violation in many U.S. states. . states. Knowing their legal boundaries instantly shifts the power toward you — because they can no longer manipulate with hidden assumptions or deny coverage without reason

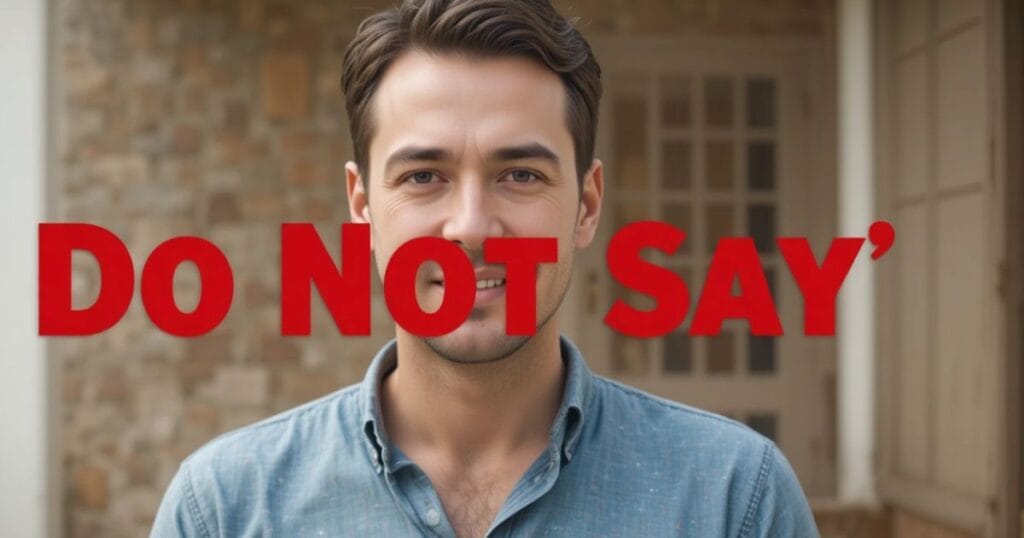

What NOT to Say to a Home Insurance Adjuster (Avoid These Traps)

The biggest mistake homeowners make is trying to sound “cooperative” — and accidentally accepting fault or weakening their claim. Adjusters record every word you say, and a single careless sentence can be used to dispute home insurance settlement later. Never say: “It might be my fault,” “I think the damage started earlier,” or “I don’t know exactly what happened.” Speculation allows them to twist your statement against you.

Avoid giving estimates or agreeing to early numbers — that is their psychological test. Never say, “That should be enough,” or “It doesn’t look too bad.” These phrases signal that you are mentally leaving money behind. Speak only in facts, not opinions. If unsure, respond with: “I will provide confirmed documentation after reviewing everything.”

How to Prepare Before Meeting the Adjuster (Winning Step Before Talking)

Preparation before the first conversation changes everything. Before allowing any adjuster into your home, you should have photos, timestamps, repair estimates, and proof of affected property ready. Organize a written summary so you do not speak from memory — that prevents errors and protects you from insurance company delay and denial strategies later in the process.

Also understand your homeowner rights during insurance claim clearly — you are legally allowed to ask for written clarification, challenge their findings, and reject their first offer. Confidence backed by documentation signals that you are not an easy target. Walking into the first call prepared is the moment you secretly take control of the negotiation before it begins.

Smart Strategies to Talk & Negotiate with an Adjuster for Maximum Payout

The adjuster’s goal is always to protect the insurance company’s money — your goal is to protect your home and recovery. That means you should never appear desperate or eager to settle fast. Stay professional, calm, and firm. When they speak, listen carefully and answer only what is asked. Never overshare or “fill in the silence.” That’s a psychological trap. This is where you apply insurance adjuster negotiation tactics — speak with confidence, refer to documents (not memory), and request everything in writing for future reference.

When they give a number, NEVER respond emotionally. Instead, say, “I will review this against my documented estimates.” If the offer is low, do not argue verbally — simply back it with evidence. Independent contractor reports, repair invoices, and professional assessments are stronger than personal opinions. The secret is to make it mathematically impossible for them to avoid lowball insurance settlement offers — their system only respects facts, not feelings.

Fire Claim Public Adjuster

In case your home damage involves a fire, then hiring a public adjuster might help you get a higher settlement. I’ve already written a full article on fire claim public adjuster that explains when you should hire one and how they negotiate on your behalf.

What to Do If You Disagree or Get a Low Settlement Offer

If the adjuster gives you a low settlement, do not accept or reject it immediately — that is exactly what they expect. Instead, request a detailed written breakdown of how they calculated the number. This forces them to justify every dollar they are trying to cut. Once you receive it, compare it with your independent contractor estimates and highlight gaps professionally — not emotionally. This is where most people fail — they argue feelings, not proof.

If the adjuster continues to push a low offer, calmly state,

“I believe this estimate does not reflect full repair cost. I’m preparing a formal response with documentation.”

This one line signals that you are ready to dispute home insurance settlement — without sounding aggressive. If needed, file a written appeal, not just a phone call. Paper trails are legal weapons. Insurance companies hate them because written records can later prove bad faith insurance claim behavior if they’re purposefully delaying or underpaying.

When to Hire a Public Adjuster or Insurance Lawyer (Clear Decision Guide)

You should not wait too long before getting professional help. If your insurance company is delaying, ignoring evidence, or keeps giving lowball insurance settlement offers, that’s a red flag. A public adjuster works for you — not the insurance company — and they are paid only when they win you more money. They can legally negotiate with insurance adjuster using insurance adjuster negotiation tactics that regular homeowners do not know. This is especially useful if the damage is big or technical, like roof, fire, or water claims.

But if your insurer starts showing bad faith insurance claim behavior, such as unreasonable delays, false policy interpretation, or forcing you into unfair settlements, then it’s time to call an insurance lawyer instead. Lawyers can push legal pressure, file official complaints, and even take the case to court if needed. They protect your homeowner rights during insurance claim and make sure the company cannot use insurance company delay and denial strategies against you.

Understanding Policy Coverage & Claim Eligibility (Informational Section)

Before filing any claim — especially related to home, fire, water, or disaster damage — it is absolutely critical to understand what your insurance policy actually covers and under what conditions it will approve or reject a claim.

✅ Key Information Points You Should Know About Your Policy:

- Type of Coverage: Is it Actual Cash Value (ACV) or Replacement Cost Value (RCV)?

- ACV only pays after depreciation is deducted (you receive less)

- RCV gives you full repair/replacement cost — no deduction

- Covered vs. Excluded Damages:

- Covers → Fire, theft, wind, hail, some water leaks

- Does NOT cover → floods, earthquakes, poor maintenance, gradual damage

- Claim Filing Time Limit:

Most companies require claims within 24–72 hours after the incident — delay = immediate suspicion or rejection. - Deductible Amount:

This is the amount you must pay first before the insurance company pays anything. - Proof Requirements:

They will request photos, repair estimates, invoices, damage reports, before-and-after evidence, etc.

How to Properly File Your Insurance Claim (Step-by-Step Guide)

Filing your claim the right way from the beginning is the biggest factor that decides whether you’ll get full payment, delay, or even rejection.

✅ Step-by-Step Claim Filing Process

1. Notify Your Insurance Company Immediately

Within 24 hours is ideal — delays create suspicion. Use official phone, app, email, or portal.

2. Provide Complete Initial Information (DO NOT leave anything unclear)

- Type of damage (fire, water, theft, storm, etc.)

- Date & time of incident

- Location and affected area

- Urgency / safety risk, if any

3. Gather Solid Evidence Before Adjuster Arrives

- Photos & videos before touching anything

- Save damaged items as proof (don’t throw away!)

- If possible — take witness statements or CCTV proof

4. Never Exaggerate or Assume Anything

Stick to FACTS ONLY — no emotional or misleading statements.

If you don’t know something → say “I will confirm and update you.”

5. Request a Claim Number & Adjuster Details

This is your case tracking proof — without this, your case doesn’t officially exist.

What NOT to Tell the Insurance Adjuster (Avoid These Costly Mistakes)

Most homeowners lose thousands of dollars simply because they say the wrong thing during the adjuster’s first inspection or phone call.

Remember — the adjuster works for the insurance company, not for you.

Here are dangerous phrases you must avoid during any conversation:

🚫 Never Say These Things to the Adjuster

- “It’s not a big damage… I think it’s minor.” → They will reduce your payout immediately.

- “I don’t know what happened exactly.” → Makes you look unreliable — possible denial.

- “Maybe it was already weak/damaged before.” → You just helped them reject your claim.

- “I think the repair will cost around $5,000.” → You set the negotiation limit too low.

- “I just want this done quickly…” → They will lowball you intentionally.

- “I don’t have all the receipts.” → You admit weak proof — never do this early.

- “You can throw this damaged item; it’s useless.” → Evidence destroyed = claim destroyed.

✅ Safe & Professional Things You SHOULD Say

- “I will provide detailed documentation shortly.”

- “Please confirm everything in writing via email.”

- “I will not sign anything until I review it properly.”

- “Can you confirm this is included in coverage?”

How to Prove the Real Value of Your Loss (So They Cannot Lowball You)

If you can prove the true value of your damage, the adjuster cannot cheat you easily — because now you have evidence stronger than their estimate.

Your goal is to force them to respect your numbers, not blindly accept theirs.

How to Deal with an Insurance Claims Adjuster

If you want to understand the general tactics insurance adjusters use across all types of claims — home, accident, or property — then reading my previous article on how to deal with an insurance claims adjuster will prepare you before the adjuster even calls.

✅ What Proof Increases Your Claim Value Instantly

Make sure you prepare these 4 powerful items before negotiation:

| Proof Type | Why It’s Powerful |

| Before & After Photos/Videos | Shows real damage & condition — kills excuses. |

| Licensed Contractor Repair Estimate | More trusted than adjuster’s cheap estimate. |

| Receipts / Invoices / Online price proof | Proves true replacement cost, not “depreciated” value. |

| Professional Damage Inspection Report | Makes your claim legally stronger and harder to deny. |

🧠 Pro Tip (Most Homeowners Don’t Know)

If the adjuster gives a low estimate — you can legally request:

✅ “A written breakdown of how you calculated this amount.”

Once they send it, you can expose missing items, unfair depreciation, or intentional mistakes — and challenge every point with evidence.

Smart Negotiation Strategy (How to Make the Adjuster Increase the Offer Without Fighting)

Most homeowners make the mistake of arguing emotionally with the adjuster.

But the real power is in calm, documented negotiation — not emotional begging.

Your mindset should be:

👉 “I am not requesting money. I am demanding what is legally mine — with proof.”

✅ The Smart Negotiation Formula (Follow This Tone)

When the adjuster gives a low offer, reply like this (calm & factual):

“Thanks for your estimate. However, according to my licensed contractor’s written report, the real repair cost is $18,750 — not $11,200.

Please review the attached documentation and let me know when we can update the offer.”

✅ You don’t threaten.

✅ You don’t beg.

✅ You force them to look again — professionally.

⚠️ Never Use These Emotional Phrases

| Wrong Phrase | Why It Damages Your Claim |

| “Please, I need this money fast…” | Makes you look desperate — easy target. |

| “This is unfair and illegal!” | Triggers defensive mode — instant resistance. |

| “I will get a lawyer immediately!” | You lose advantage — use this only when needed. |

✅ Use Powerful But Calm Words Instead

| Smart Phrase | Psychological Effect |

| “Let’s re-evaluate based on documented facts.” | Shows control & confidence. |

| “I have additional evidence you may have missed.” | Forces them to listen carefully. |

| “Please confirm this in writing for my records.” | Scares them from lying. |

What to Do If the Adjuster Still Gives a Low or Unfair Settlement Offer

Even after strong proof, insurance companies may still stall, underpay, or play time-delay games to see if you’ll give up or accept less.

This is where you switch from basic negotiation to pressure-building mode — still legally and professionally.

Step-by-Step Action Plan If You Get a Lowball Offer

| Action | What It Does |

| 1. Ask for a Written Explanation | Forces them to justify the low offer — this is powerful evidence. |

| 2. Send a Counter-Offer with Contractor’s Estimate | You are not begging — you are legally correcting their mistake. |

| 3. Request an Official “Reinspection” | Adjuster must return and review damage again — many increase offer here. |

| 4. Document Every Delay or Excuse (email only) | This prepares you to prove bad faith insurance claim behavior later. |

The Magic Sentence That Makes Adjusters Take You Seriously

“Please provide a written breakdown explaining how you calculated this number — including what damages you excluded — so I can forward it to my legal advisor for review.”

✅ You didn’t threaten.

✅ You simply mentioned legal review, which activates fear inside insurance companies.

✅ 7 out of 10 adjusters will immediately raise the offer after this sentence.

When to Hire a Public Adjuster or Insurance Lawyer (Clear Decision Guide)

Most homeowners wait too long to get professional help — and end up losing $10,000 to $50,000+ in rightful compensation. The key is to hire help at the right time, not when it’s already too late.

✅ Instantly Hire a Public Adjuster or Lawyer If Any of This Is Happening

| Situation | What It Means | Action |

| Adjuster is ignoring your emails or calls | They are using insurance company delay and denial strategies | Hire Public Adjuster immediately |

| Offer is too low with no explanation | They think you don’t know your rights | Get Public Adjuster to re-evaluate claim |

| Adjuster is saying certain damage is “not covered” | Possible bad faith insurance claim behavior | Contact Insurance Lawyer, not just PA |

| Insurance keeps asking for “more documents” repeatedly | This is a stall technique | Hire Public Adjuster, now |

| Claim is already over 30–45 days delayed | Strong risk of denial coming soon | Hire Public Adjuster or Lawyer immediately |

Public Adjuster vs Insurance Lawyer (Simple Comparison)

| Who to Hire | Best For | Cost |

| Public Adjuster (PA) | Low offer, unfair inspection, fighting for more payout | 5–10% of payout (only if you win) |

| Insurance Lawyer | Claim denial, fraud accusation, severe dispute home insurance settlement | Free consultation, gets paid only if you win (percentage based) |

⚠️ If your claim is denied, do NOT appeal yourself — you only get ONE chance. You must let a lawyer handle denial professionally.

What Happens If Your Home Insurance Claim Is Denied or Delayed? (Immediate Action Plan)

A claim denial or delay doesn’t mean it’s over — it simply means the insurance company is testing how strongly you’re willing to fight. Most homeowners lose money because they panic and accept defeat, not because they were actually wrong.

Two Main Situations You Might Face

1. Claim is Delayed (Over 30–45 Days)

This is usually a strategy, not a mistake. It’s meant to exhaust you financially and mentally so you accept a lowball settlement.

2. Claim is Denied

The insurer may say your damage is “not covered”, “wear and tear”, or “not enough proof” — but in MANY cases, this is a negotiation tactic, not a final answer.

What You Must Do Immediately (Based on Situation)

| Scenario | Action |

| Delayed over 30–45 days | Send a written “Formal Demand for Status Update” email. This puts legal pressure. |

| Denied claim | Do NOT respond emotionally. Forward the denial letter to a public adjuster or insurance lawyer right away. |

| Offered extremely low payout | Tell them you will “formally request claim re-evaluation” (Don’t accept or reject yet.) |

| Adjuster is unresponsive | Document every call/email as evidence. This strengthens your proof of bad faith insurance claim behavior. |

LEGAL FACT (Homeowner Rights During Insurance Claim)

You have the right to:

- Request every reason in written form if denied

- Request a second inspection by a different adjuster

- Hire your own adjuster or attorney anytime

- File a “bad faith claim” lawsuit if they delay or manipulate you

Final Expert Advice — Protect Yourself, Not the Insurance Company

Most homeowners make one painful mistake — they trust the insurance company more than they trust themselves. Remember this truth: insurance adjusters are not your financial protectors; they are financial defenders of the insurance company.

Golden Rules You Must Never Forget

1. Never assume their first offer is final — it’s almost always a test.

Most companies start with a lowball insurance settlement offer to see if you’re desperate.

2. Always communicate in writing — never rely only on phone calls.

Written communication builds legal proof in case you need to dispute home insurance settlement later.

3. If you feel something is wrong — it probably is.

Unusual delays, tricky wording, or pressure to “settle fast” are signs of

insurance company delay and denial strategies — be alert.

Expert-Level Power Tip (Almost No Homeowner Knows This)

If you ever feel the adjuster is using insurance adjuster negotiation tactics to confuse or pressure you — immediately mention:

“I’m fully aware of my homeowner rights during insurance claim, and I’m prepared to involve a public adjuster if necessary.”

This one sentence instantly changes their tone — because they now know you cannot be manipulated.

Final Line Before You Take Action

Protect your payout — not their profits.

Your job is not to be “polite”; your job is to be paid fully and fairly for your loss. That’s what real preparation and negotiation achieve.

if your situation is fire related you must read this next

How to Deal with Insurance Adjuster After a House Fire

conclusion

Final Expert Advice — Protect Yourself, Not the Insurance Company

Insurance companies run a business. Their priority is to pay you as little as legally possible, even if you’ve been paying them for years. That’s why your first goal is to stay calm, stay factual, and never let emotions or assumptions take over during the claim.

The smartest homeowners win claims because they document everything, speak only in facts, and never accept a low offer without proof and review. If something feels unfair, you have every right to push back, request it in writing, ask for re-evaluation, or bring in a public adjuster or attorney — that is not being difficult, it is being smart.

Remember this rule:

You are not being rude — you are protecting your home, your rights, and your money.

FAQS

| Question | Answer |

| What not to tell a homeowners insurance adjuster? | Never admit fault, guess repair costs, exaggerate damage, or say “I’m fine.” Only share facts backed by proof. |

| How to negotiate with a home insurance adjuster? | Use documented evidence, contractor estimates, and confidently reject lowball offers with supporting facts. |

| What is the 80% rule in homeowners insurance? | You must insure your home for at least 80% of its replacement cost, or the insurer can reduce your payout. |

| What to expect when an insurance adjuster comes to your house? | They’ll inspect damage, take notes/photos, ask detailed questions, and try to find reasons to reduce payout. |

| How do adjusters minimize payouts? | They use delay tactics, question damages, apply depreciation, and look for policy loopholes to undervalue claims. |

| How to get the most out of a home insurance claim? | Document everything with photos, keep receipts, get third-party quotes, and negotiate — never accept first offer. |

| Can you trust your insurance adjuster? | Not completely — they work for the insurance company, not for you. Always protect your own financial interest. |

| What tactics do claim adjusters use? | They use delay, denial, confusion, quick low settlements, and psychological pressure to save insurer money. |

Muhammad Maaz, founder of InjuyCrashGuide.com — sharing simple, real-life accident and insurance guidance to help people stay informed and protected.