What Is a Fire Claim Public Adjuster & How Do They Help?

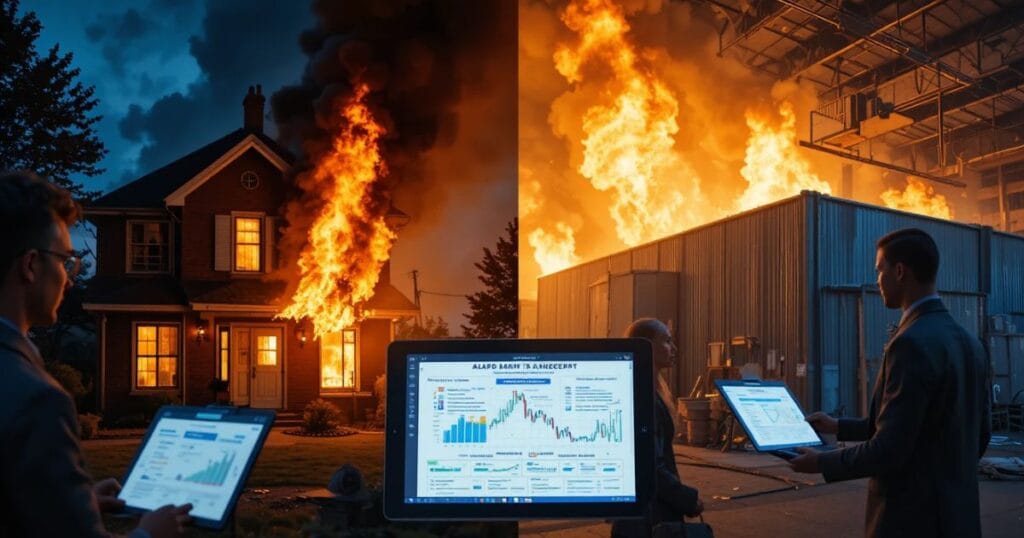

A Fire Claim Public Adjuster is a licensed expert who represents homeowners and businesses after a fire disaster to secure the highest possible insurance settlement. Unlike the insurance company’s adjuster, they work only for you — not the insurer. Their role includes documenting hidden damage, exposing policy loopholes, and negotiating aggressively to prevent underpayment. Whether it’s residential fire damage claim support, commercial fire insurance claims, or complex business interruption insurance claim, a public adjuster fights to recover every dollar you’re entitled to. They even uncover hidden smoke and HVAC damage and ensure your maximum fire insurance payout is not reduced by technical traps or unfair insurer tactics.

They support you when your home or business is damaged by smoke, flames, or even water from firefighters. Most homeowners do not know hidden damage inside walls, hidden smoke and HVAC damage, or future repair costs. That is why insurance companies easily underpay. A real public adjuster protects you from that loss and knows how to get full payout from fire insurance claim legally and fast.

What Does a Fire Damage Insurance Adjuster Do?

People often ask — what does a fire insurance adjuster do exactly? A public adjuster inspects every corner of the property and documents even invisible damage. They create a professional fire damage restoration assessment with photos, pricing breakdowns, and evidence of long-term risk. They understand insurance policy language, policy exclusions and coverage analysis, and how to unlock money you did not know existed in your insurance plan.

They act as the public adjuster to negotiate fire damage insurance directly with your insurer. That means you never have to argue or beg. They use facts, insurance law, and forensic tactics to push for full fair compensation — including additional living expenses claim, code upgrade insurance coverage, and even future risks most people overlook.

Types of Fire Insurance Claims We Handle

A strong public adjuster manages residential fire damage claim support for homes, apartments, mobile homes, and condos. They understand personal belongings, relocation costs, smoke cleanup, and emotional stress. A good adjuster does not treat it as only physical loss but as life interruption, family protection, and legal right.

How to Deal with Insurance Adjuster

For a complete and updated breakdown of the whole process, you can also read my full guide — How to Deal with Insurance Adjuster (Complete Guide 2025). It explains everything from first contact to final settlement.

They also work on commercial fire insurance claims, restaurants, retail stores, rental properties, hotels, warehouses, and factories. They take over the complex business interruption insurance claim process. They bring forensic accounting for insurance claims to prove income loss, payroll interruption, and contractual penalties. They even specialize in multi-unit fire damage claims such as large apartment buildings.

Why Hire a Public Adjuster Instead of Handling Claim Yourself?

Filing alone is dangerous. Insurance companies are trained to protect their profit — not yours. They use loopholes, confusing terms, and pressure to make you accept less. Most people make mistakes or miss claims such as hidden smoke and HVAC damage or lifetime risk of structural instability. One mistake means thousands of dollars lost forever.

A public adjuster knows how to fight back. They have won hundreds of claims before. They know who helps homeowners with fire damage insurance ethically. They cost nothing upfront because do public adjusters charge upfront fees? The answer is no. They get paid only after they increase your payout successfully.

Example Table: Claim Value Difference

| Who Files the Claim | Average Payout Rate |

| Homeowner Alone | 25% – 45% of real value |

| With Public Adjuster | 200% – 600% more |

Step-by-Step Fire Damage Claim Process

The first step is immediate inspection and policy review. Experts document damage inside ceilings, walls, flooring, electronic wiring, smoke pathways, structural cracks, and safety hazards. After that they prepare a complete structural fire damage inspection report that insurance cannot ignore.

Next comes filing and negotiation. This is where fire claim negotiation experts take control. They handle communication with insurance, fight low offers, and if required, can public adjuster reopen denied fire claim even months later. They protect you from mistakes and secure faster results. If needed, they legally escalate the claim without you entering any risk.

Fire Claim Underpaid or Denied? Here’s the Solution

If your claim was low, stalled, or denied, do not panic. A professional adjuster can a public adjuster help after insurance underpays your original settlement and reopen the entire case. That includes even closed claims or those marked as final by your insurer.

They gather strong evidence, bring new facts, and force a fair re-evaluation. Many homeowners who thought nothing could be done later recovered tens of thousands more because they did not give up. A denied claim is not the end — it is often just the start of real negotiation.

Public Adjuster vs Fire Insurance Attorney — Which One Is Better?

Both are useful, but they are not the same. A public adjuster is first line of action. They take over documentation, filing, inspection, damage rebuilding values, and maximum fire insurance payout negotiations. They do not charge retainer fees.

A fire insurance attorney is usually called only when the case becomes legal conflict or lawsuit. They are powerful but cost heavy and work slower. A smart strategy is simple — first hire the best fire claim adjuster near me, not the attorney, unless the adjuster confirms legal escalation is required.

Why AlliedPA (or Your Brand) Is the Top Choice for Fire Claim Help

AlliedPA is known as one of the most trusted fire claim public adjuster networks in the USA. They have helped thousands recover fair settlements — even in delayed or denied cases. They do not take payment until you win. Their team includes licensed inspectors, accountants, legal advisors, and deeply experienced negotiators.

Every case gets full technical breakdown, instant damage survey, 24/7 assistance, and aggressive strategy. They are not just consultants — they are real fire claim negotiation experts with major recovery history across wildfire, residential, luxury property, hotel, and warehouse-level claims.

General adjuster knoledge

If you want a basic understanding of how an insurance claims adjuster works, you can also check my guide on how to deal with an insurance claims adjuster. It explains the adjuster’s role and how they negotiate with you.

Ready to Maximize Your Fire Insurance Claim?

If your home or business was damaged by fire, never wait for the insurance company to act. The sooner you get help from a wildfire insurance claim adjuster or local expert, the stronger your recovery will be. Waiting even one week can allow insurance to reduce or block coverage.

This is the right time to act with power — not fear. With expert support, you get paid not just for damage, but relocation, upgrades, loss of income, code compliance, long-term safety repair, and full family recovery confidence.

Frequently Asked Questions (FAQs)

how long does fire insurance settlement take? It depends, but with public adjuster support it becomes much faster because they push aggressively instead of waiting for slow response.

how to file a fire claim for business interruption? It requires profit records, operational proof, expense tracking — all handled best by forensic claim specialists.

can public adjuster reopen denied fire claim? Yes. Even after months. Denied is not final when facts exist.

do public adjusters charge upfront fees? No. They get paid only after increasing your payout successfully.

Final Expert Advice — Don’t Let the Insurance Company Underpay You

Fire claims are not simple repair cases — they are financial battles. Insurance companies always start low. The only way to secure what you truly deserve is to let a skilled public adjuster fight on your behalf. Whether your claim is new, delayed, or already rejected, this is your chance to reopen it, recover losses, and legally win your right to full protection.

If you need fire claim public adjuster support right now — act immediately. Waiting only benefits them. Acting now protects you.

FAQS

What is a public adjuster?

A public adjuster is a licensed professional who represents policyholders—not the insurance company—to help them get the highest insurance payout.

What is the claim process for fire insurance?

You report the fire, document all damages, submit required proof, and negotiate the payout with the insurance company.

Which type of adjuster makes the most money?

Public adjusters handling commercial or large loss fire claims typically earn the highest income.

What is the formula for fire claim?

Fire claim = Total property damage + additional expenses – policy deductible.

How is claim settlement done?

After verification and negotiation, the insurance company approves the claim amount and releases payment.

How many days to claim insurance?

Most policies require filing a fire insurance claim within 30 to 60 days of the incident.

Fire Damage Specific

If your insurance claim is related to a house fire, I have already written a detailed article on how to deal with an insurance adjuster after a house fire. It covers the exact steps you should take immediately after the incident.

Muhammad Maaz, founder of InjuyCrashGuide.com — sharing simple, real-life accident and insurance guidance to help people stay informed and protected.